Mercury Bullion Savings

Savers in the MBS program can convert their gold and silver into bars at any time once their MBS holding meets the specified conversion threshold of 50 grams for gold and 1 kg for silver. These physical bullion bars converted from savings are minted by MKS PAMP, an LBMA Good Delivery List refiner.

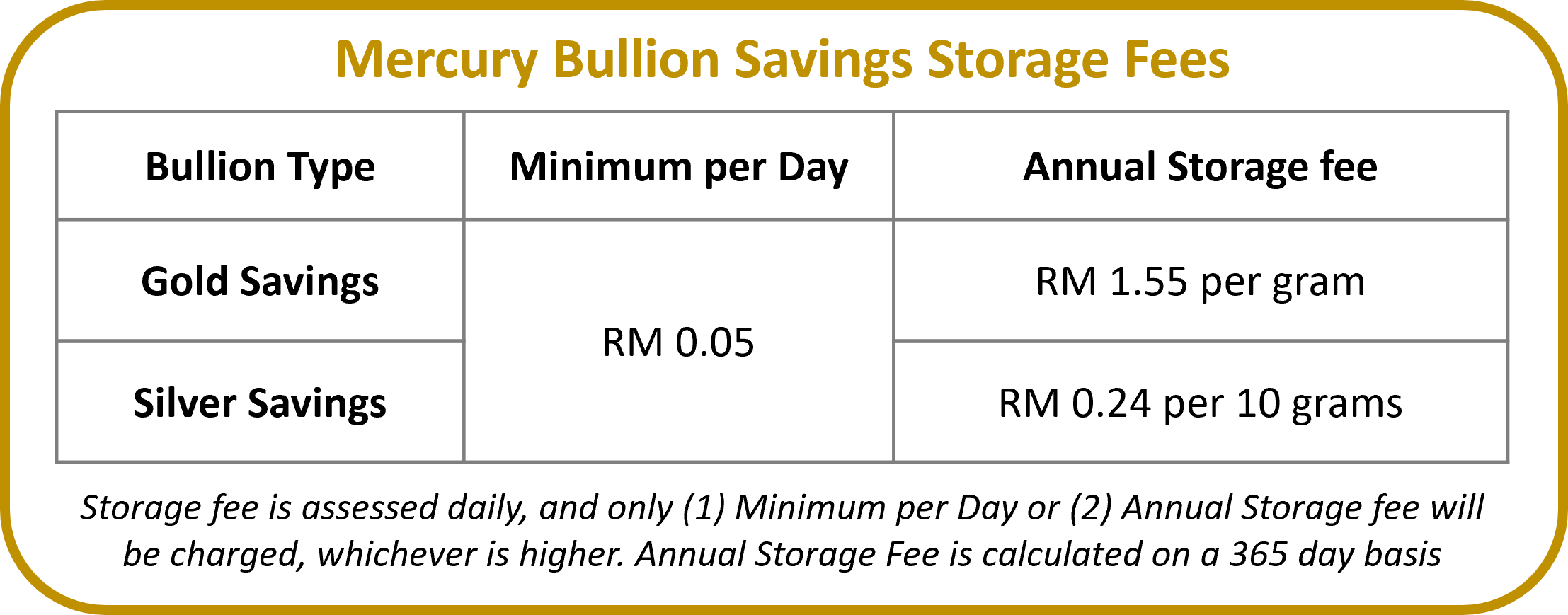

Your bullion holdings will also be assessed a storage fee, calculated daily, as we must allocate space in our vaults for your holdings. Rest assured, our storage fees are the lowest in the market, starting at just RM 0.05 per day, and you can be sure your bullion is safely held. Do note that storage fees are calculated daily and billed yearly on 15th March, with a late payment fee of RM15 if you do not make storage fee payment within 30 days.

Many companies will charge you conversion fees when you convert to physical bullion - that is why they can convert such small weightage of gold. We charge low conversion fees for converting Savings into precious metals bars, and Savings can also be sold back to Mercury Gold at any time. Gold and Silver investment should be as transparent as possible! Click here for a tutorial guide on setting up an account.

Commonly Asked Questions

1. What is the Mercury Bullion Savings (MBS) Gold Investment Malaysia programme?

The Mercury Bullion Savings (MBS) programme by Mercury Gold offers an affordable way to invest in gold and silver. Starting from just RM50, you can purchase fractional gold and silver, with all holdings fully backed by physical bullion. MBS allows you to collect your savings over time and, upon reaching a certain limit, convert them into internationally-minted gold or silver bars.

2. How much do I need to invest to start the Gold Investment Malaysia programme?

You can begin investing with just RM50 per transaction through the Mercury Bullion Savings (MBS) programme. This small start allows you to gradually gather gold or silver over time. Once your savings reach a limit, you have the option to convert them to physical gold bars or silver bars.

3. What are the advantages of investing through the MBS programme?

Investing through the MBS programme offers the advantage of the lowest storage fees at just RM0.05 per day. We also charge a low conversion rate when converting to gold or silver bars. Plus, you can easily sell back to Mercury Gold anytime for added flexibility.

4. Are there any additional costs associated with the Gold Investment Malaysia programme?

Storage fees are calculated daily at just RM0.05 per day, making it the lowest rate in the market. These fees are billed annually on 15 March, with a late payment fee of RM15 if not settled within 30 days. We also offer low conversion charges when you choose to convert your holdings into physical gold or silver bars.

5. Can I convert my savings into physical bullion?

Yes, you can convert your savings into physical bullion. Savers in the MBS program may convert their gold and silver holdings into bars once they meet the minimum threshold of 50 grams for gold and 1 kilogram for silver.

6. Are there any conversion fees for changing my savings into physical bullion?

Savers in the Mercury Bullion Savings program can convert their gold and silver into bars at any time once their MBS holding meets the specified conversion threshold of 50 grams for gold and 1 kg for silver.. We charge low conversion fees for converting savings into precious metals bars (currently 2% for Gold and 6% for Silver), and savings can also be sold back to Mercury Gold at any time.

7. Where are the physical bullion bars minted?

The physical bullion bars in the MBS program are minted by international refineries, such as MKS PAMP, which is an LBMA Good Delivery Refiner. This accreditation ensures that all gold and silver bars meet strict international standards for purity, weight, and quality. Investors can be assured of the authenticity and global recognition of the bullion they receive.

8. How are storage fees calculated?

Storage fees in the MBS program are calculated daily at a fixed rate of RM0.05 per day, making it one of the most affordable options in the market. These fees are accumulated throughout the year and billed annually on 15 March. A late payment charge of RM15 applies if the invoice is not settled within 30 days.

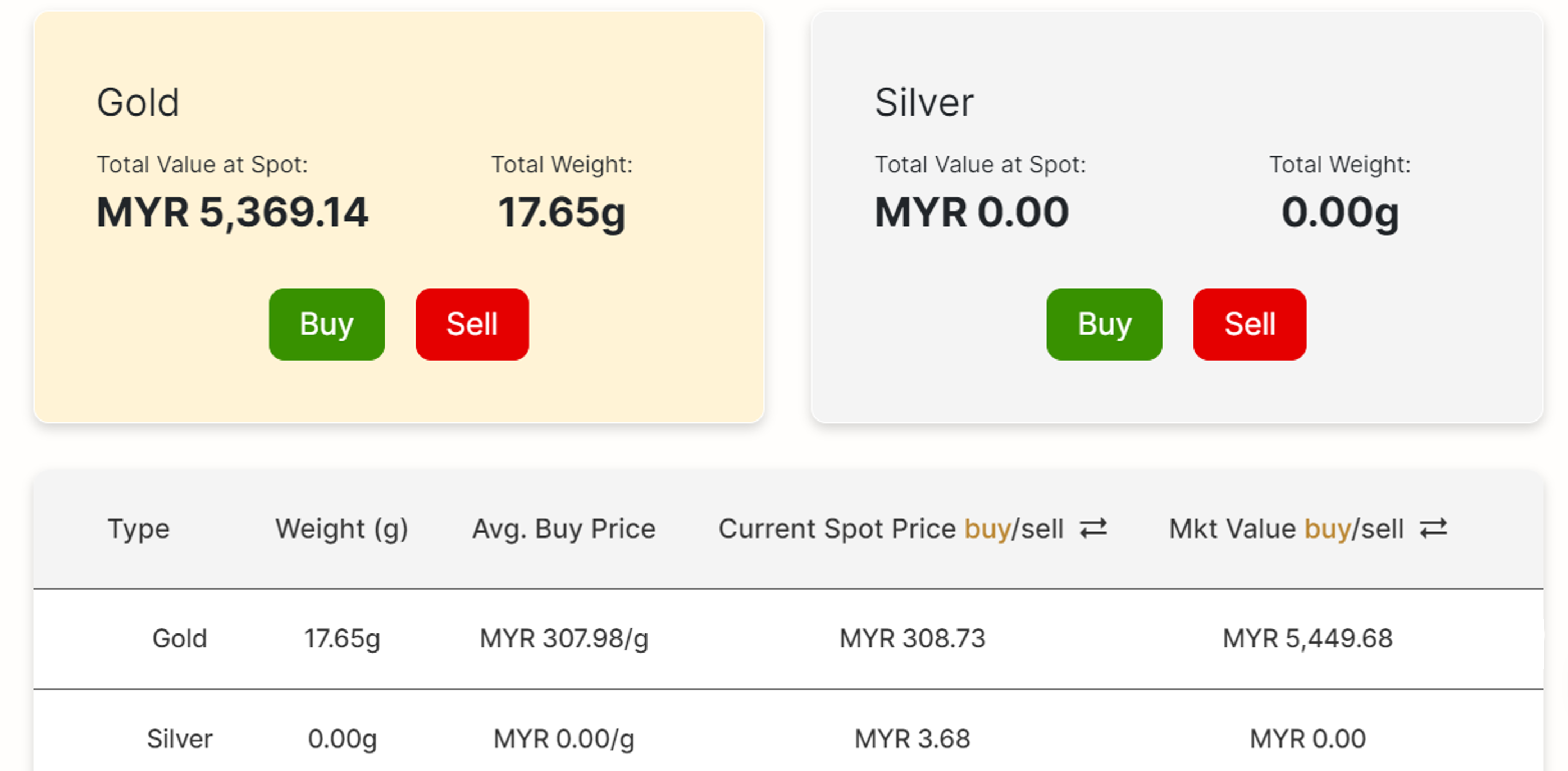

9. What happens if I want to sell my Gold and Silver investments?

Mercury Bullion Savings can be bought or sold at any time at market prices and a small premium. Our premiums for MBS are some of the lowest in the market. Additionally, Mercury Gold is part of the Mercury Securities Group, listed on the ACE market of Bursa Malaysia. Our group has over 30 years of experience in financial markets and risk management. Your holdings are secure.

10. Is the MBS programme transparent?

Unlike many other retailers, we never disguise our premiums by inflating spot prices or manipulating FX rates. Instead, we source all pricing data directly from trusted international exchanges in real time, ensuring our customers always see exactly what they’re paying for. Our fees and premiums are clearly listed and easy to understand, with no hidden markups or surprise charges. This level of transparency allows our clients to make informed decisions with complete confidence, knowing they are receiving fair, competitive pricing backed by industry-standard benchmarks.