Gold Holds Just Below Record High After Recent Rally

Credit: Reuters

As the dollar and Treasury yields held firm after strong U.S. data flagged doubts on whether the Federal Reserve would deliver three interest rate cuts this year.

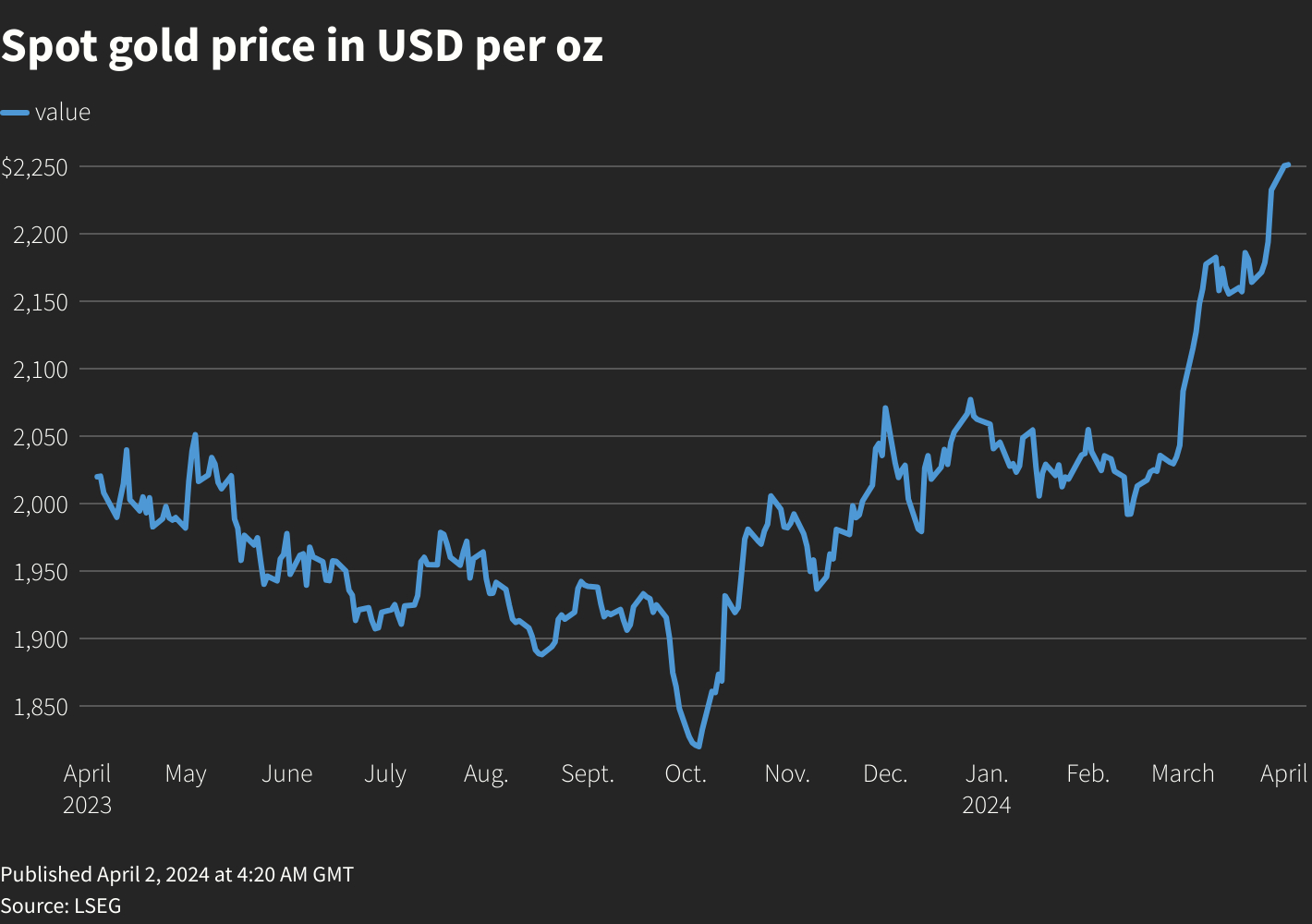

Spot gold edged up 0.2% at $2,253.94 per ounce, as of 0624 GMT, holding below an all-time high of $2,265.49 hit on Monday. U.S. gold futures gained 0.8% to $2,274.60.

"Gold notched up a new record price, though with that high watermark also came some overbought conditions, which have resulted in a mild pullback. However, recent pullbacks in gold have been shallow in nature due to potential buyers waiting on the sidelines for better entry points," said Tim Waterer, chief market analyst at KCM Trade.

Bullion's gains were held in check as the dollar hit a 4-1/2-month high, while benchmark U.S. 10-year Treasury yields were trading near their highest levels in two weeks after data showed U.S. manufacturing grew for the first time in 1-1/2 years in March.

Fed Chair Jerome Powell on Friday indicated the latest U.S. inflation data did not undermine the central bank's baseline outlook, but said with the economy on a strong footing, "that means we don't need to be in a hurry to cut".

"Traders will be casting an eye towards Friday's U.S. nonfarm payrolls release, because if we happen to see another strong jobs report this could provide a catalyst for a gold pullback," Waterer said.

Gold tends to gain when interest rates are cut as it reduces the opportunity cost of holding bullion.