Political Uncertainty Boosts Gold’s Safe-Haven Appeal as Silver Weakens

Credit: Kitco

“Gold’s rally to new highs came on the back of continued professional buying interest while the physical market had slowed down; this is normal when a new price range is establishing itself and those markets will build again as would-be purchasers get used to the new levels,” O'Connell wrote in an in-depth technical analysis of gold and silver on the StoneX blog. “Ultimately momentum did run out as the price made new highs, but what was interesting was that the rally came as US economic numbers were stronger than expected and therefore might, in earlier times, have put pressure on the gold price.”

“This can almost certainly be put down to the fact that the markets are increasingly expecting a rate cut in September,” she said, “while in the background the fact that Mr. Trump was gaining more ground in the Presidential race would have helped as his vigorous geopolitical attitudes and his pro-industry stance, plus his approach to international trade and tariff imposition are all elements that would support gold.”

O'Connell said that the market is likely moving into “an extended period of limbo” as the Democrats work through a period of transition from Biden’s candidacy ahead of the party Chicago convention on August 19-22, with Vice President Kamala Harris as the early frontrunner to replace him.

“Kamala Harris has the alliance of a number of powerful Democrats, including a few that might have been considered contenders, but at the time of writing she notably lacks endorsement from the Obamas, with Barack talking of an open process, and Nancy Pelosi has been silent so far,” she noted. "The Chair of the Party said [Sunday evening] that ‘the work that we must do now, while unprecedented, is clear. In the coming days, the Party will undertake a transparent and orderly process to move forward as a united Democratic Party with a candidate who can defeat Donald Trump in November.’”

In a separate analysis, O'Connell said she believes the presidential race “will now be closer than previously expected, leading to volatility, at least until Harris policies are clear.”

“Longer-term is probably more favourable for gold if Trump is in the White House,” she said. “Trump would be inflationary and potentially somewhat incendiary in geopolitical terms, while Harris’ foreign affairs policy is as yet undefined so that favours gold for now, but possibly not in the longer term.”

O'Connell cautioned investors that “it’s far too early for any strategic positions,” but said that “the overall outlook for gold remains positive on the back of geopolitics and economic uncertainty.”

Turning to the precious metals flow data, she noted that “gold ETFs added 20t over the past six days, all of which were net creation days, and the net change over the month to date is 33t, while silver has lost 24t so far this month. The past three days have seen some bargain hunting so it is possible that we may have turned the corner, but – rather like the Fed – we need more data!”

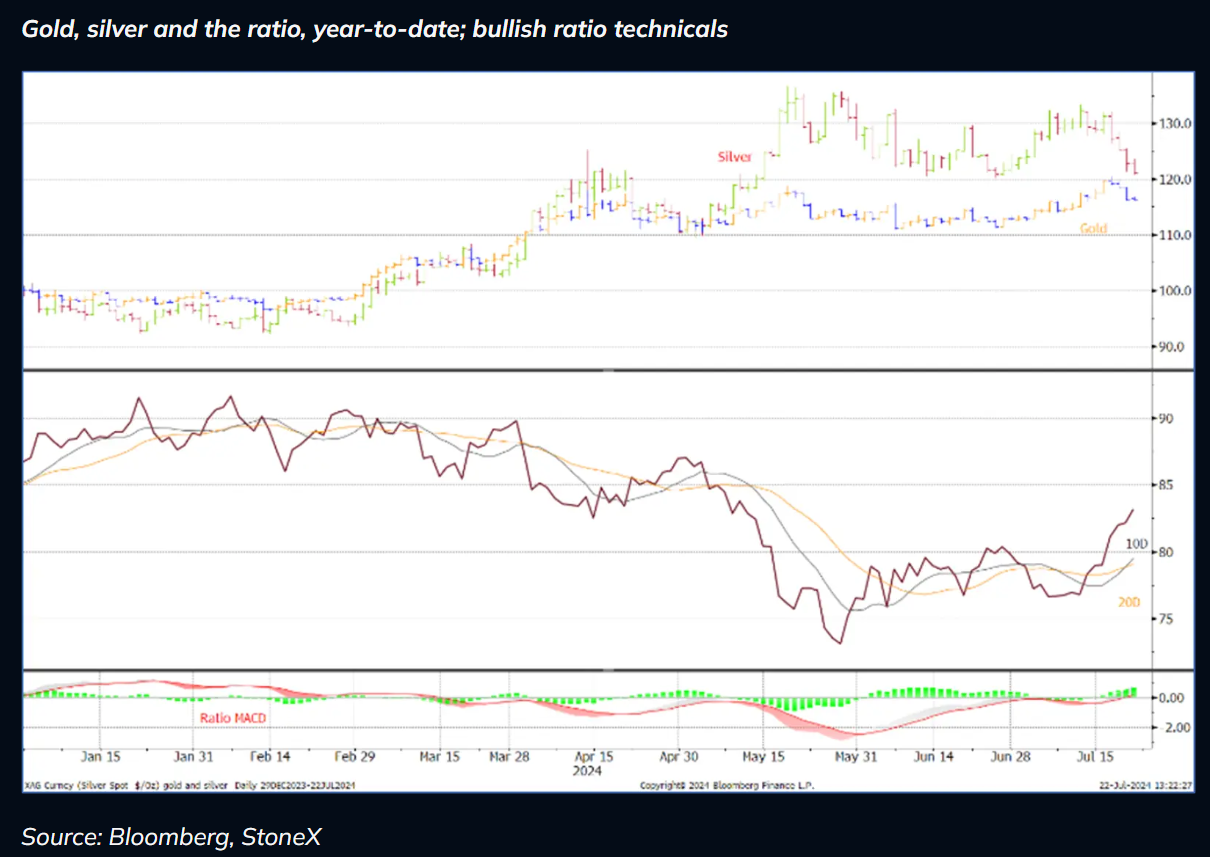

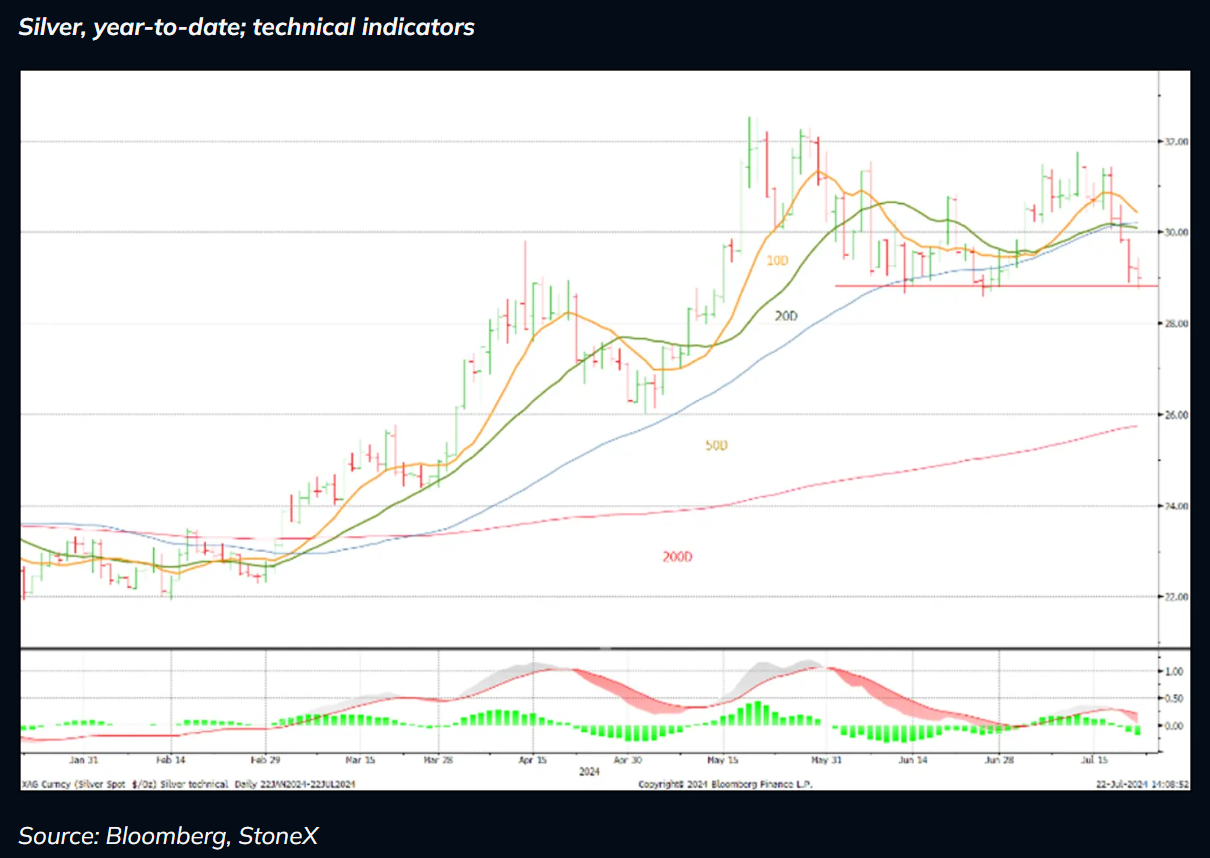

O'Connell also pointed out that while the gold:silver ratio’s technical indicators were looking bullish last week, “the 10-day moving average has now moved above the 20-day, which may continue to bode ill for silver.”

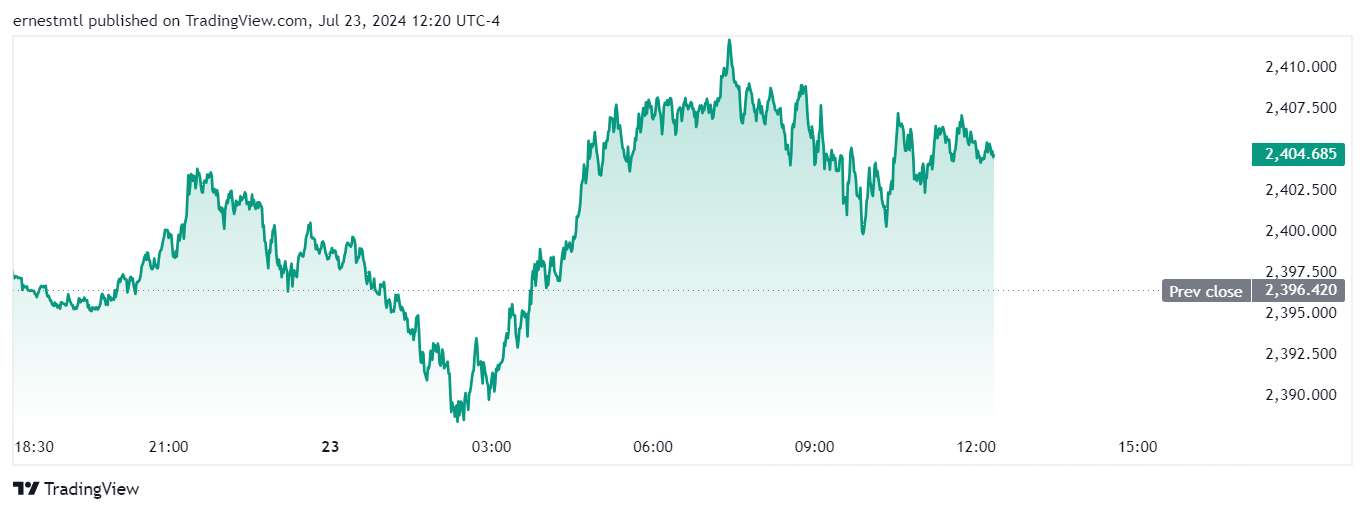

Spot gold continues to hover near the $2,400 support level on Tuesday, last trading at $2,404.56 per ounce for a gain of 0.34% on the session.

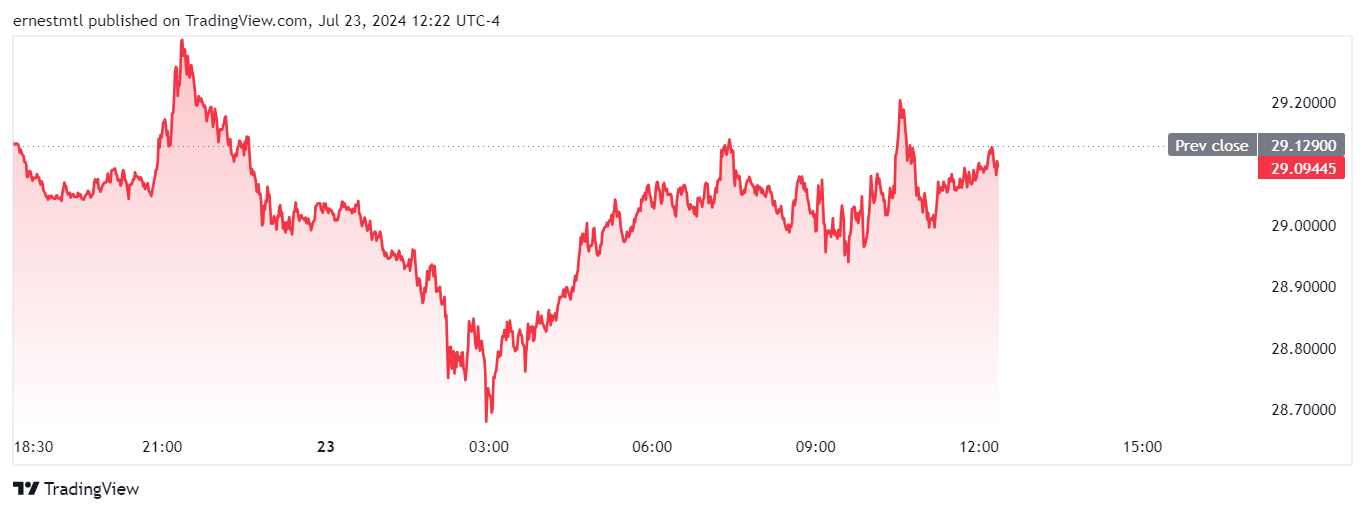

Meanwhile, spot silver continues to underperform the yellow metal, last trading at $29.094 per ounce for a loss of 0.14% on the daily chart

At Mercury Gold, we offer a wide range of gold bars and coins for sale in Malaysia to suit your investment needs. As a trusted source for physical gold bullion in Malaysia, we also provide secure and convenient options, including gold savings accounts (Mercury Bullion Savings (MBS) program) which starts at just RM50. Discover the best place to buy gold in Malaysia with Mercury Gold, offering competitive prices and expert guidance on where and when is the best time to buy gold in Malaysia. Explore our platform to buy gold Malaysia online, to enjoy an easy and reliable experience. Invest with confidence and let Mercury Gold be your partner in building your investment goal.

Click here to view more.